Indian bank deposits better protected than in US: SBI report

ANI

20 Mar 2023, 12:33 GMT+10

Mumbai (Maharashtra) [India], March 20 (ANI): Research by SBI said US smaller bank deposits are insured in the range of 30-45 per cent only while in contrast, smaller bank deposits in India such as regional rural banks, cooperative banks, and local area banks are better protected at 82.9 per cent, 66.5 per cent, and 76.4 per cent respectively.

Analysis of insured customer deposits across multiple geographies initiated in the wake of bank runs across developed economies reveal US's top 10 banks deposits are insured in the range of 38.4-66 per cent, according to a research titled, Ecowrap, of the State Bank of India's Economic Research Department.

Another interesting trend that has been observed in the US is that top banks' deposits, on an average, have been insured to the tune of around 50-55 per cent.

The research also said Indian banks were the epitome of resilience. Foreign claims on India are USD 104.2 billion on an immediate counterparty basis, and USD 81.5 billion as a guarantor basis.

Immediate counterparty basis means the methodology whereby positions are allocated to the primary party to a contract whereas guarantor basis meant methodology whereby positions are allocated to a third party that has contracted to assume the debts or obligations of the primary party if that party fails to perform. According to World Bank, foreign claims are defined as the sum of cross-border claims plus foreign offices' local claims in all currencies.

When compared with other major countries, India has the least foreign claims, both as a counterparty basis, and also as a guarantor basis, the report said.

"Further, our ratio of foreign claims to domestic claims is also least among countries signifying that our banking and financial system is very disciplined and no international balance sheet contagion can start from India. Maturity wise also, International claims on India are the least among major countries," Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, said who authored the report.

The report said the recent rise in policy rate of 50 bps by European Central Bank (ECB) could not have been more counter-intuitive, coming amidst the mayhem that sparked a massive sell-off in the pack of banks, including systemically important banks from the European Union (EU) and the United Kingdom (UK), eroding USD 60 billion in a single day on March 15 alone.

The research added, however, if history had any rear-view mirror, the quantum of unsynchronised rate decisions by ECB in the last 25 years pre- and post -the global financial crisis (GFC) is looking grossly mis-timed.

Soumya Kanti Ghosh said, "We feel the fissures of the present shock, after a year of war and three years of the pandemic, may prove to be quite a costly affair for the health of beleaguered European banking system going forward even as ECB continues branding Euro area banking sector as resilient, with strong capital and liquidity positons, as on September 2022, not factoring the rise in borrowing costs and the resultant decline in demand, along with tighter credit standards, all leading to a vortex."The research also said separately, the short-term borrowing like uninsured deposits by First Republic Bank, of USD 30 billion from a suite of 11 different US-based banks, for an ultra-short term period of 90 days, is shortsighted if we compare such packages in India in 2008 and 2020 when the consortium of banks or champion banks handheld the ailing banks for a multiyear period. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sydney Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sydney Sun.

More InformationBusiness

SectionFedEx, UPS step up as Canada Post loses market share in strikes

OTTAWA, Canada: With Canada Post struggling to maintain operations amid labour unrest, rivals like FedEx and UPS are stepping in to...

U.S. stocks steady Tuesday despite tariffs turmoil

NEW YORK, New York - U.S. and global markets showed a mixed performance in Tuesday's trading session, with some indices edging higher...

Beijing blamed for covert disinformation on French fighter jet Rafale

PARIS, France: French military and intelligence officials have accused China of orchestrating a covert campaign to damage the reputation...

Birkenstock steps up legal battle over fakes in India

NEW DELHI, India: Birkenstock is stepping up its efforts to protect its iconic sandals in India, as local legal representatives conducted...

Beijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

Wall Street reels after Trump invokes new tariffs

NEW YORK, New York - Monday's trading session saw mixed performances across U.S. and global markets, with several major indices posting...

International

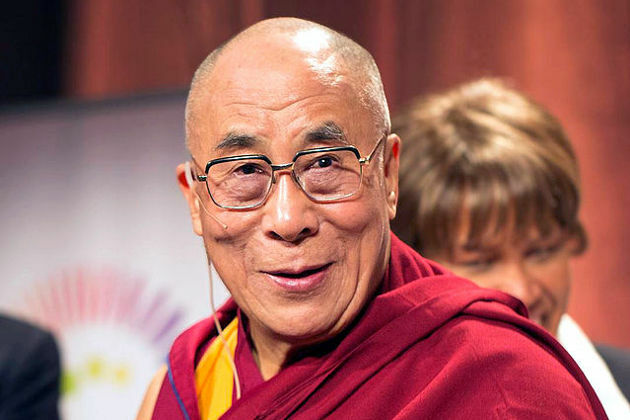

SectionThousands gather in Himalayas as Dalai Lama celebrates 90th birthday

DHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,...

Fans perform WWII-era Fascist salute at Marko Perković’s mega concert

ZAGREB, Croatia: A massive concert by popular Croatian singer Marko Perković, known by his stage name Thompson, has drawn widespread...

U.S. Treasury Secretary says Musk should steer clear of politics

WASHINGTON, D.C.: Elon Musk's entry into the political arena is drawing pushback from top U.S. officials and investors, as his decision...

TikTok building U.S.-only app amid pressure to finalise sale

CULVER CITY, California: TikTok is preparing to roll out a separate version of its app for U.S. users, as efforts to secure a sale...

Trump defends use of 'Shylock,' citing ignorance of slur

WASHINGTON, D.C.: President Donald Trump claimed he was unaware that the term shylock is regarded as antisemitic when he used it in...

Summer travel in chaos as French air traffic controllers walk off job

PARIS, France: A strike by French air traffic controllers demanding improved working conditions caused significant disruptions during...