MONEYME (ASX: MME) achieves record FY23 gross revenue of >$230M exceeding guidance; increases 4Q23 originations to $127M

PR Newswire

01 Aug 2023, 10:00 GMT+10

SYDNEY, Aug. 1, 2023 /PRNewswire/ -- Digital lender and non-bank challenger MONEYME (ASX: MME) has achieved record annual gross revenue of >$230 million (up >60% from $143 million in FY22), reduced office operating costs to income from 40% to below 25% in FY23, and increased originations to $127 million in the fourth quarter (up from $98mm in 3Q23).

As part of its strategy to build a sustainable and profitable business in the current economic environment, MONEYME has capitalised on scale benefits and streamlined operations, transitioned to a higher credit quality asset base, and reset its capital base.

MONEYME rounded out the financial year by achieving a number of significant funding milestones in 4Q23, including completing the planned SocietyOne corporate debt paydown, settlement of its $37 million institutional placement and $4.3 million SPP, and a $150 million term securitisation transaction.

The integration of SocietyOne and increased automation, including extending its fully automated approval capabilities to include secured assets, have increased MONEYME's operating leverage and cost efficiency. Office operating costs to income reduced to >25% in FY23, compared to 40% in the previous year.

MONEYME's loan book has achieved a reduction in net losses quarter-on-quarter in the second half, as a result of improvements to its credit quality. Its average Equifax credit score is now 724, up from 704 in FY22 and 718 in 3Q23. Around 83% of the book has an Equifax score above 600 compared to 79% for FY22, and 63% for FY21.

In line with its strategy to moderate growth and build a strong credit portfolio, MONEYME's gross customer receivables reduced slightly from $1.3 billion to $1.1 billion in FY23, while achieving record gross revenue of >$230M.

MONEYME had updated its annual gross revenue guidance from >$200m to >$220m in January after a strong first half result, yet still exceeded the updated guidance.

Originations increased to $127m in 4Q23, up from $98m in the prior quarter.

MONEYME is now well placed to achieve profitable and sustainable growth in FY24 and beyond, building on its existing scale and technology benefits, and plans to gradually grow originations while maintaining its focus on higher credit quality assets to navigate the business through a more challenging credit risk environment.

Clayton Howes, CEO & Managing Director of MONEYME said: "It's pleasing to end the financial year in such a strong position. We have achieved record revenue, significantly improved office operating costs, and improved our credit quality.

"In 4Q23, we achieved a number of significant funding milestones despite tight capital markets. We closed our $41.3 million capital raise and repaid the SocietyOne acquisition debt. We also secured a $150 million term securitisation deal for SocietyOne personal loan assets. These funding achievements have successfully reset MONEYME's capital base and strengthened our funding and liquidity position, enabling us to continue to deliver profits and lay the groundwork for future growth.

"It's impressive how quickly the team transitioned from two years of high growth to consolidate the business for sustainable and profitable growth. This puts us in a very strong position to deliver returns for our shareholders."

The full year results, highlighting the impact of scale benefits and consolidation, will be published after an auditor's review.

About MONEYME

MONEYME is a leading Australian disruptor using technology to become the #1 challenger to the major banks.

With a focus on innovation, it funds credit approved ambitious people with the advantage of market-leading speed and automated customer experiences. Leveraging AI and advanced cloud-based technology, it offers highly automated credit products across personal, auto and real estate finance.

The Group's core brands MONEYME and SocietyOne reflect digital-first experiences that meet, and exceed, the expectations of 'Generation Now'.

MONEYME Limited is listed on the ASX and the Group includes licensed and regulated credit and financial services providers operating in Australia.

For more information, visit moneyme.com.au or investors.moneyme.com.au

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sydney Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sydney Sun.

More InformationBusiness

SectionWall Street steadies Wednesday, indices end modestly lower or unchanged

NEW YORK, New York - U.S. stocks closed modestly lower Wednesday despite a tentative trade agreement between the United States and...

Reimagining Protein: Innovations That Could Prevent the Next Pandemic

Throughout human history, zoonotic diseases, illnesses that jump from animals to humans, have shaped civilizations, triggered pandemics,...

Clean energy faces hurdles as US solar forecast dips by 2030

WASHINGTON, D.C.: A boom in U.S. solar energy installations may be running out of steam as shifting federal priorities, new tariffs,...

Oil prices flat amid trade talks and rising OPEC+ output

NEW YORK CITY, New York: Oil prices remained steady on June 9 as investors looked ahead to the outcome of the U.S.-China trade talks...

Coal vs. water: India’s energy push fuels local shortages

CHANDRAPUR/SOLAPUR (India): As India doubles down on coal to fuel its growing energy needs, an invisible crisis is surfacing: the country...

Nasdaq Composite climbs 124 points on China-U.S. trade talks optimism

NEW YORK, New York - U.S. stock markets rose Tuesday as investors and traders anticipated a positive outcome from ongoing trade talks...

International

SectionDeep divides mark Poland’s runoff election

WARSAW, Poland: Poland held a second round of voting in its presidential election on Sunday, but exit polls show the race is too close...

Greta Thunberg, others stopped while attempting to break Gaza blockade

WEST JERUSALEM, Israel: Israeli forces stopped a boat heading to Gaza and detained Greta Thunberg and other activists on board early...

Fresh IVF error raises alarm over clinic safety and oversight

MELBOURNE, Australia: A second embryo mix-up in just two months has pushed one of Australia's largest IVF providers back into the spotlight,...

Trump and Musk feud goes viral on X

WASHINGTON, D.C. A public fight between U.S. President Donald Trump and billionaire Elon Musk has taken over social media, especially...

Human traffickers exploit new deadly route from Africa to Europe

DERA BAJWA, Pakistan: Amir Ali, a 21-year-old man from Pakistan, dreamed of going to Europe for a better life. He was promised a visa...

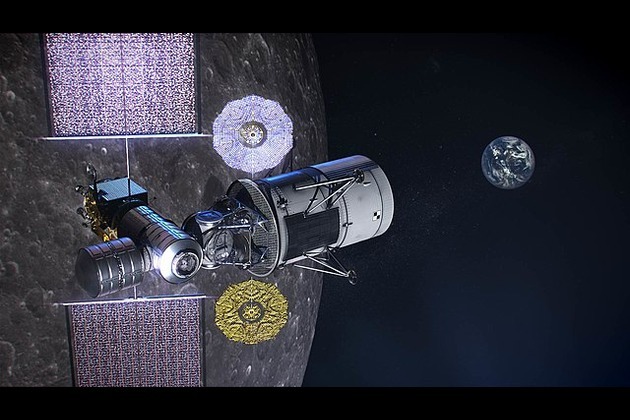

ispace lander crashes on moon; Japan faces new lunar setback

TOKYO, Japan: Japan's hopes for a foothold in commercial lunar exploration suffered a second blow this week after Tokyo-based startup...